LINLEY CAPITAL invests in companies with a $100 million to $2 billion range of revenue in the United States, Canada, Latin America and Europe in the industrial, technology, energy, e-commerce, financial and consumer sectors.

Industries & Sectors

TECHNOLOGY MEDIA & TELECOM

Electronics Hardware, Semiconductor Equipment, Electronic Manufacturing Services, Traditional Software, Cloud Computing (SaaS, IaaS, PaaS), Data Center & Hosting Services, Telecom Infrastructure, VoIP Solutions, Electronic Payment Solutions, IT Security Solutions

Industrials & Manufacturing

General Industrial Manufacturing, Automotive, Packaging Solutions, Chemicals & Specialty Chemicals, Waste Management & Recycling Solutions, Parts Supply & Distribution, Security Systems, Training & Simulation Software, Traffic Control & Communication Systems

Energy & Clean Tech

Smart Grid Technology, Oil & Gas Services and Technology, Mining Services & Technology, Renewable Energy Technology (Wind-Solar-Hydro), Electrical Transmission Networks, Nuclear Power Technology

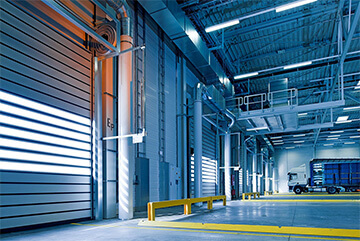

E-Commerce & Business Services

E-Commerce Businesses, E-Commerce Software, Payment Systems, Logistics and E-Commerce 3-PL, Warehouse Management Solutions, Security & Cleaning, Staffing Services

Financial & Capital Markets

Financial Technology, Insurance & Warrant, Consumer Credit, Risk Management Solutions, Revenue Cycle Management

Consumer & Retail

Apparel & Grocery Retail, Luxury Products, Health & Wellness, Food & Beverage, Household & Personal Care, Restaurants, Travel & Lodging, Franchises

Globalization

We believe middle-market companies can benefit from globalization and the continued integration of economic, political, social and cultural relations across international boundaries. The international exchange of goods, services, capital, technology and knowledge will continue to expand and middle-market companies will benefit by becoming more interconnected, using global resources and by accessing the international marketplace.

LINLEY CAPITAL seeks to invest in middle-market companies and support businesses in their growth and expansion, which can include investments to increase market share outside its country of origin. For example, a North American business, that seeks to expand in the European or South American marketplace or vice versa. LINLEY CAPITAL can help in accessing these opportunities and navigating the related risks, such as new and different business conditions, supplier and logistics challenges, currency exposure and foreign laws and regulations.

COMPANY ATTRIBUTES

- Talented management teams

- Sustainable market share and competitive advantages such as advanced operating methods, superior products or brand equity

- Opportunities for growth through investment in new plant, property and equipment, the expansion of product-lines and the entry into international markets

- Opportunities for expansion through mergers and acquisitions

- Companies in industries with a long-term growth perspective and limited exposure to macro-economic swings and industry events or to the risk of technological or product obsolescence

TRANSACTION TYPES

MANAGEMENT BUYOUTS

Acquisitions of stand-alone companies, subsidiaries or divisions led by its management. LINLEY CAPITAL will back management teams in providing acquisition financing and transaction support for management buyout situations. For example, we will support management teams in buying a subsidiary company they are managing but which is owned by a larger parent corporation.

PRIVATE OR FAMILY-OWNED COMPANIES

The large majority of US and European companies are privately held or family-founder-owned businesses. LINLEY CAPITAL is experienced in working through transaction and estate planning scenarios that address the specific financial and transition needs of the founders while ensuring the continued growth of the company and the support of management.

RECAPITALIZATIONS

A recapitalization is a means of refinancing, to provide liquidity or dividends to the shareholders while not requiring a total sale of the company. A recapitalization can be appealing to a founding shareholder, by monetizing some of their ownership while retaining a significant interest in the business.

GROWTH FINANCINGS

LINLEY CAPITAL invests in companies that are seeking an equity partner to fund growth opportunities. In these situations, LINLEY CAPITAL can fund equity for the expansion of product lines, add-on acquisitions, international expansion and new plant, property and equipment.

RECAPITALIZATIONS AND BANKRUPTCIES

A recapitalization can also involve an insolvent company whereby LINLEY CAPITAL invests in the company as a means of settling debts with the company’s creditors.

ORPHAN BRANDS

These are the smaller, older brands that have lost market share and are being sold-off by large multinationals or family offices. LINLEY CAPITAL is experienced in acquiring these companies to revive their brand equity and market share.

CORPORATE SPIN-OFFS OR DIVESTITURES

LINLEY CAPITAL will support management teams to acquire and revitalize non-core divisions from their larger parent company.

CONSOLIDATIONS AND ROLL-UPS

LINLEY CAPITAL will support management teams to acquire and revitalize non-core divisions from its larger parent company.

INVESTMENT PROCESS

LINLEY CAPITAL sources its investments through relationships with national and international financial advisory firms, its operating advisors and through its network of US, European and Latin American family office investors. LINLEY CAPITAL is experienced in working through a multitude of transaction issues including cross-border mergers and acquisitions, family owned corporations, tax or estate planning and management incentive structures. When appropriate, it will accommodate the seller’s specific transaction structure needs. LINLEY CAPITAL works with some of the most experienced transaction service providers in the United States and Europe so as to ensure a fair, organized and efficient investment process.